Will my 1098-T form show my entire Social Security number? Non-resident aliens are generally not eligible for educational tax benefits. It depends on whether you are a non-resident alien for federal income tax purposes. I am an international student, do I need a 1098-T form? Or visit their website Internal Revenue Service. You can also call the IRS at 1-80, Monday-Friday, 7:00 AM - 10:00 PM. For details, check out IRS publication 970. UCSC cannot advise you on your tax situation. Only you and your tax consultant can determine if you are eligible for any educational tax benefits. What are the educational tax benefits that the IRS offers? UCEAP uses Tab Services Corporation (TSC) to issue 1098-Ts, so you may look for your 1098-T online at the TSC website: UCSC Extension students with questions may contact us at: Address: UCSC Extension, 3175 Bowers Avenue, Santa Clara, CA 95054 Website: Students who are nonresident aliens for income tax purposes (unless requested by the student). Students who take classes where no academic credit is offered even if the student is otherwise enrolled in a degree program. Students who don’t have a Form 1098-T showing they attended an eligible. So, you can use the credit to pay any tax you owe but you won’t receive any of the credit back as a refund. UCSC may not furnish a 1098-T for the following students: The amount of the credit is 20 percent of the first 10,000 of qualified education expenses or a maximum of 2,000 per return. This information is required for 1098-T reporting. UCSC does not have your social security number. You had no qualified tuition and related expenses/ scholarships or grants for the calendar year.

Some of the most common reasons for not receiving a 1098-T are: UCSC's Federal Tax ID Number is: 94-1539563 What is the Federal Tax ID Number for UCSC? No, the 1098-T form is completed by UCSC. Please keep your receipts)Įxpenses that are not reported on the 1098-T Form (Since UCSC cannot track any amounts paid for books and supplies, no amounts will be reported on the 1098-T form. Books and supplies that are required for course instruction.

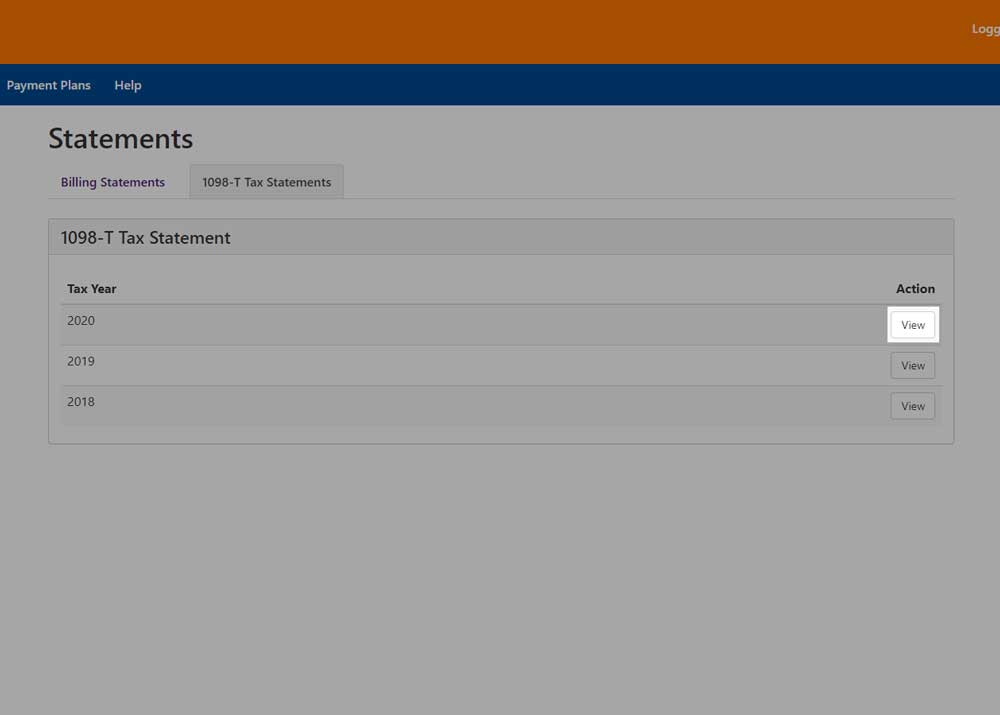

#1098 t qualified education expenses registration

Registration and tuition fees that are required to enroll at UCSC.

0 kommentar(er)

0 kommentar(er)